Uniswap and Cross-Chain Token Transfers: Trading Tokens Across Different Networks

Uniswap and Cross-Chain Token Transfers: Trading Tokens Across Different Networks

What is Uniswap?

Uniswap is a decentralized exchange protocol built on the Ethereum blockchain. It allows users to trade ERC-20 tokens without the need for intermediaries or central authorities. Uniswap utilizes an automated market-making system where liquidity providers lock their tokens into smart contracts, enabling other users to trade against these liquidity pools. This innovative protocol has gained significant popularity due to its trustless nature and user-friendly interface.

The Need for Cross-Chain Token Transfers

As the decentralized finance (DeFi) ecosystem expands, there is a growing need for interoperability between different blockchain networks. Cross-chain token transfers enable users to move their assets seamlessly between various networks and leverage the unique features and opportunities available on each chain. This capability allows users to access a broader range of tokens and liquidity, making their DeFi experience more diverse and prosperous.

Uniswap and Cross-Chain Token Transfers

Uniswap, primarily built on the Ethereum network, initially limited the trading of ERC-20 tokens. However, with the rise of cross-chain solutions, Uniswap has integrated with other networks such as Binance Smart Chain (BSC) and Polygon (formerly Matic Network). This integration enables users to trade tokens across different blockchains, expanding the scope of available assets and fostering cross-chain liquidity.

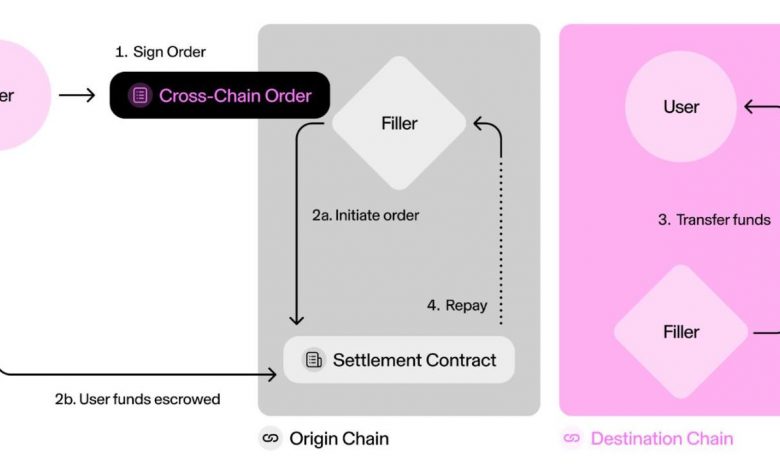

How Does Uniswap Facilitate Cross-Chain Token Transfers?

Uniswap achieves cross-chain token transfers through the implementation of bridge protocols. These bridge protocols act as connectors between various blockchain networks, allowing assets to move seamlessly across them. When a user initiates a cross-chain token transfer on Uniswap, the bridge protocol ensures the proper transfer of tokens between the source network (e.g., Ethereum) and the destination network (e.g., Binance Smart Chain).

Benefits of Cross-Chain Token Transfers on Uniswap

1. Enhanced Liquidity: With the ability to trade tokens across different networks, users can tap into larger pools of liquidity, increasing their chances of finding better trading opportunities and achieving better prices.

2. Diverse Asset Selection: Cross-chain token transfers enable users to access a wider range of assets. This diversity allows for more strategic investment decisions and portfolio diversification.

3. Reduced Fees: By leveraging cross-chain transfers, users can take advantage of lower transaction fees on alternative networks and avoid high gas fees on congested networks like Ethereum.

Frequently Asked Questions (FAQs)

Q: Is Uniswap the only platform for cross-chain token transfers?

A: No, there are other platforms like SushiSwap, 1inch, and PancakeSwap that also support cross-chain token transfers.

Q: Are there any risks associated with cross-chain token transfers?

A: While cross-chain transfers offer various benefits, there are potential risks, including technical vulnerabilities, bridge failures, and the possibility of scams or hacks. Users should exercise caution and conduct thorough research before engaging in cross-chain token transfers.

Q: Is there any additional fee for cross-chain token transfers on Uniswap?

A: Uniswap charges a standard transaction fee for trades that occur on its platform. However, additional fees may apply when using bridge protocols to facilitate cross-chain transfers. It is essential to understand the fee structure before initiating a transfer.

In conclusion, Uniswap has emerged as a leading decentralized exchange enabling cross-chain token transfers. This functionality allows users to trade tokens across different blockchain networks, enhancing liquidity, diversifying asset selection, and reducing transaction fees. However, it is important for users to be aware of the risks associated with cross-chain transfers and perform due diligence before engaging in such transactions. By leveraging the opportunities provided by cross-chain token transfers, users can unlock the full potential of the DeFi ecosystem.